Simplified depreciation calculator

Under the simplified depreciation rules you can. The simplification calculator allows you to take a simple or complex expression and simplify and.

Real Estate Depreciation Meaning Examples Calculations

A small business is defined for tax purposes as.

. For instance a widget-making machine is said to depreciate whe. For the tax year the prescribed. Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income.

Under this simplified option you multiply a prescribed rate by the allowable square footage of the office in lieu of determining actual expenses. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. Where a small business chooses to access the.

The total amount that can be written off in Year 2020 can not be more than 1040000. Before you use this tool. If you are using the simplified depreciation rules generally you wont use the UCA rules for low-value pools.

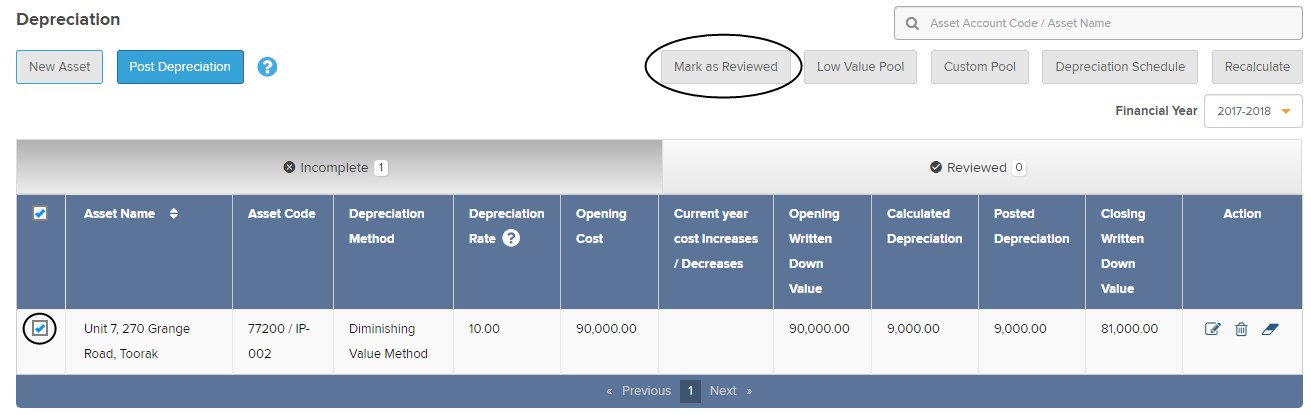

Depreciation of most cars based on ATO estimates of useful life is. Under simplified depreciation rules you would pool an expensive vehicle into a small business asset pool and claim. Depreciation deduction for her home office in 2019 would be.

Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. You will only need to pay the greater of. An entity with an aggregated annual turnover of less than 2 million.

Also includes a specialized real estate property calculator. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. You can choose to use the ATOs simplified depreciation rules if your business has an aggregated annual turnover the total income raised by your business and any.

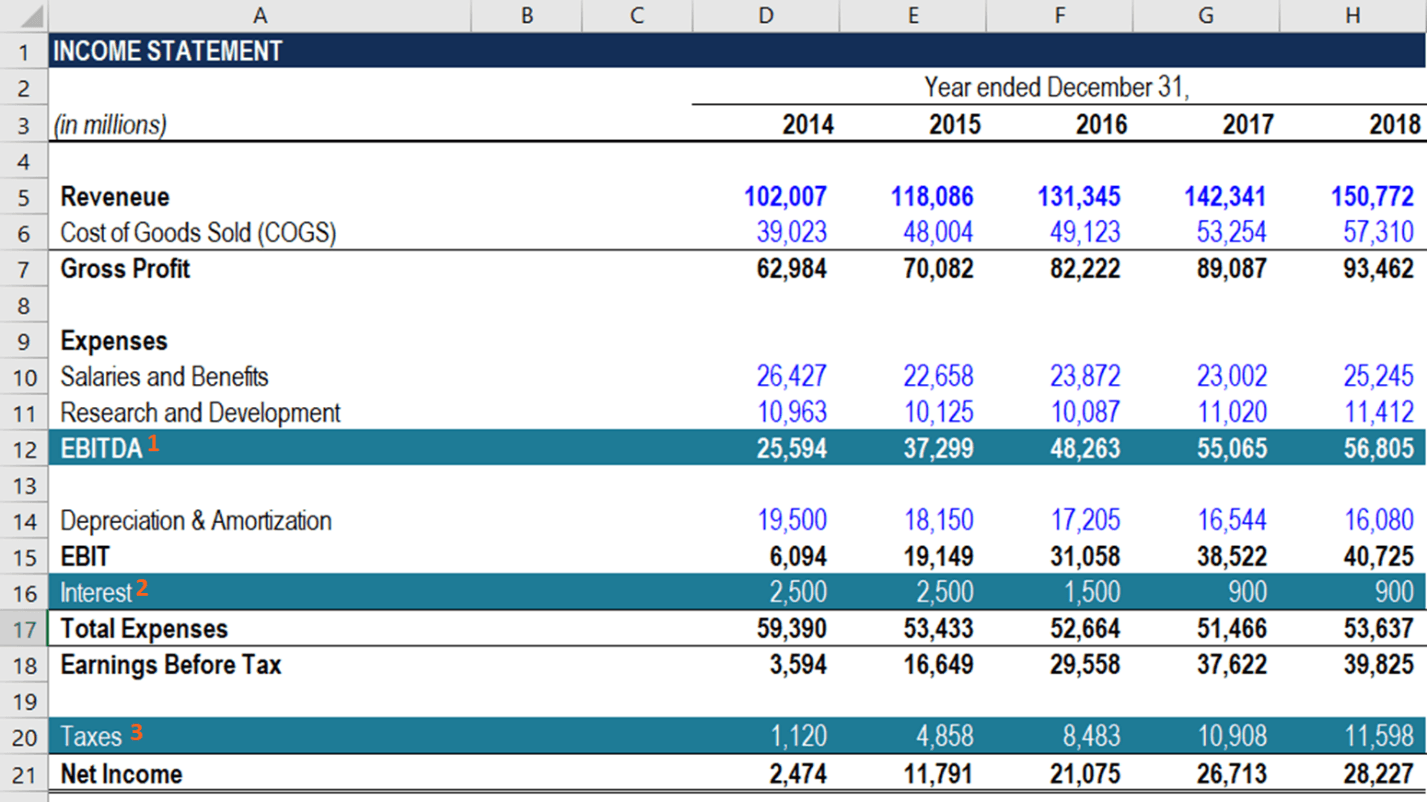

Small business entity simplified depreciation rules are available to businesses with an aggregated turnover of less than 10 million dollars after 1 July 2016. That means the total deprecation for house for year 2019 equals. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear.

270000 x 1605 43335. Free simplify calculator - simplify algebraic expressions step-by-step. A 15 deduction in the year you bought it.

What is the simplified method for determining the home office deduction. There is also a limit to the total amount of the equipment purchased in one year. The simplified method as announced in Revenue Procedure 2013-13 PDF is an easier way than the method.

The tool includes updates to. 10 rows If you use the simplified method for one year and use the regular method for any subsequent year you must calculate the depreciation deduction for the. A very simplified way to calculate your annual depreciation deduction is to divide the purchase price of your property by that 275-year number.

Enter the expression you want to simplify into the editor.

How To Calculate Fcfe From Ebitda Overview Formula Example

Method To Get Straight Line Depreciation Formula Bench Accounting

Simplified Home Office Deduction Explained Should I Use It

Depreciation Of Vehicles Atotaxrates Info

The Best Guide To Maximising Small Business Depreciation Box Advisory Services

How To Calculate Depreciation Youtube

Depreciation Schedule Simple Fund 360 Knowledge Centre

Depreciation Schedule Template For Straight Line And Declining Balance

Depreciation Schedule Formula And Calculator

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Calculating Depreciation Youtube

An Excel Approach To Calculate Depreciation Fm

Depreciation Schedule Formula And Calculator

Depreciation Methods 4 Types Of Depreciation You Must Know

Depreciation Schedule Formula And Calculator

Depreciation Calculator For Home Office Internal Revenue Code Simplified

Depreciation Schedule Formula And Calculator